According to Gaap Regarding Leasing Discloures Which of the Following

74 codified in SAB Topic 11M Disclosure Of The Impact That Recently Issued Accounting Standards Will Have On The Financial Statements Of The Registrant When Adopted In A Future Period SAB 74. A general description of leases The basis and terms and conditions on which variable lease payments are determined.

90 of the fair value of the asset.

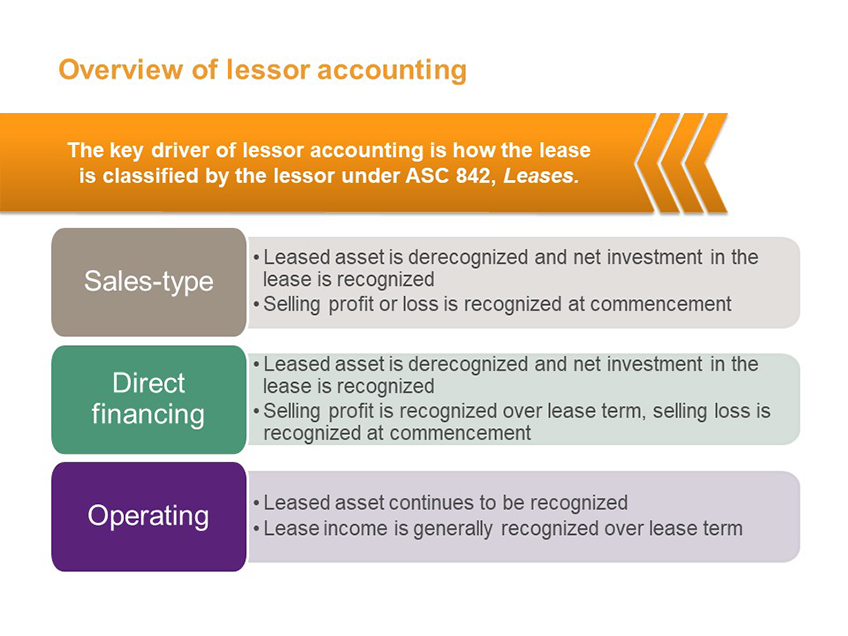

. Disclosure of a major customers identity is required. Two of the GAAP lease accounting criteria for capital leases concern the disposition of the equipment at the end of the contract. The adoption of Accounting Standards Codification ASC 842 Leases makes accounting much more complex for traditional operating leases.

Unlike finance leases however accounting for operating leases is substantially different under the new standard. Immaterial items must be disclosed. Qualitative Disclosures Nature of leases as well as any subleases including.

A lessee shall disclose information about all of the following. If the company owns the equipment or has an option to purchase the equipment at a bargain price. Combined component entirely in Topic 606 is required to disclose the following by class of underlying asset.

The ASU affects all companies and other organizations. All lease arrangements must be reported on the balance sheet Capital leased assets must be reported as a fixed asset on the balance sheet Lease payments expected within the next 1 year must be reported as a liability debt on. For the lessee to account for a lease as a capital lease the lease must meet.

Geographic area information must be disclosed in interim financial statements. 75 of the fair value of the asset. 75 of the cost of the asset.

The fact that it elected the expedient 2. Leasing is an important activity for many organizationswhether a public or private company or a not-for-profit organization. Because IFRS is very general in its provisions for lease accounting the required disclosures for leases under IFRS are more detailed and extensive than those required under US.

In periods prior to adoption of the leasing standard entities are required to make disclosures under the SECs Staff Accounting Bulletin No. Which classes of underlying asset the lessor made the election to 3. Segment information does not have to be in accordance with generally accepted accounting principles.

All four of the criteria specified by GAAP regarding accounting for leases. It is a means of gaining access to assets obtaining financing and reducing an organizations exposure to the risks of full ownership of the underlying asset. Accounting for finance leases under ASC Topic 842 and for capital leases under the legacy lease standard are similar because they both require a lessee to record an asset and liability for the present value of the lease payments.

The amendments in this Update require lessors to classify and account for a lease with variable lease payments that do not depend on a reference index or a rate as an operating lease if both of the following criteria are met. Multiple Choice The measurement of segment profit and loss disclosure need not be similar to the measurement provided to the chief operating decision maker Segment information does not have to be in accordance with generally. SAB 74 requires that when a recently.

False IFRS does not provide detailed guidance for leases of natural resources sale-leasebacks and leveraged leases. 90 of the cost of the asset. Which of the following statements is true according to US.

Not surprisingly the disclosure requirements are quite extensive. The nature of a the lease component and nonlease components that. Additionally the new leases standard has specific requirements as to how leasing activity is to be presented in the basic financial statements.

Lease Presentation Disclosure Requirements. The lease would have been classified as a sales-type lease or a direct financing lease in accordance with the classification criteria in. According to Topic 840-10-15 regarding leasing disclosure which of the following statements is are true.

GAAP regarding operating segment disclosure.

Lease Accounting An Overview Of Asc 842 Gaap Dynamics

Comparability Of Financial Statements In Ifrs And Local Gaap Around Download Scientific Diagram

Ifrs 16 Vs Us Gaap Asc 842 Bridging The Gap For Lease Accounting

Solved 1 Which Of The Following Sources Of Generally Chegg Com

Wiley Practitioner S Guide To Gaap 2022 Interpretation And Application Of Generally Accepted Accounting Principles Wiley

Leases Ifrs 16 In The Statement Of Cash Flows Ias 7 Youtube

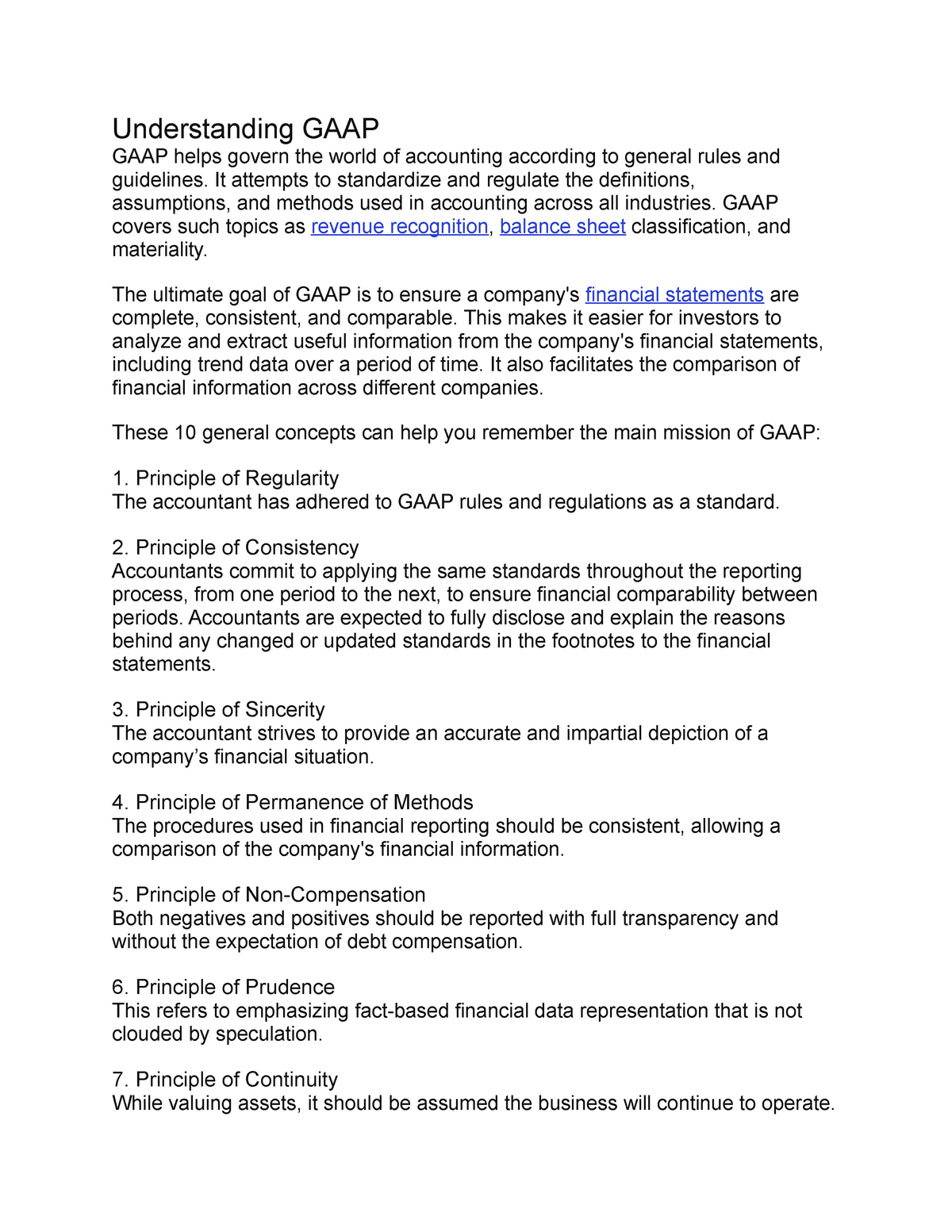

Gaap Lecture Notes 1 2 Understanding Gaap Gaap Helps Govern The World Of Accounting According To Studocu

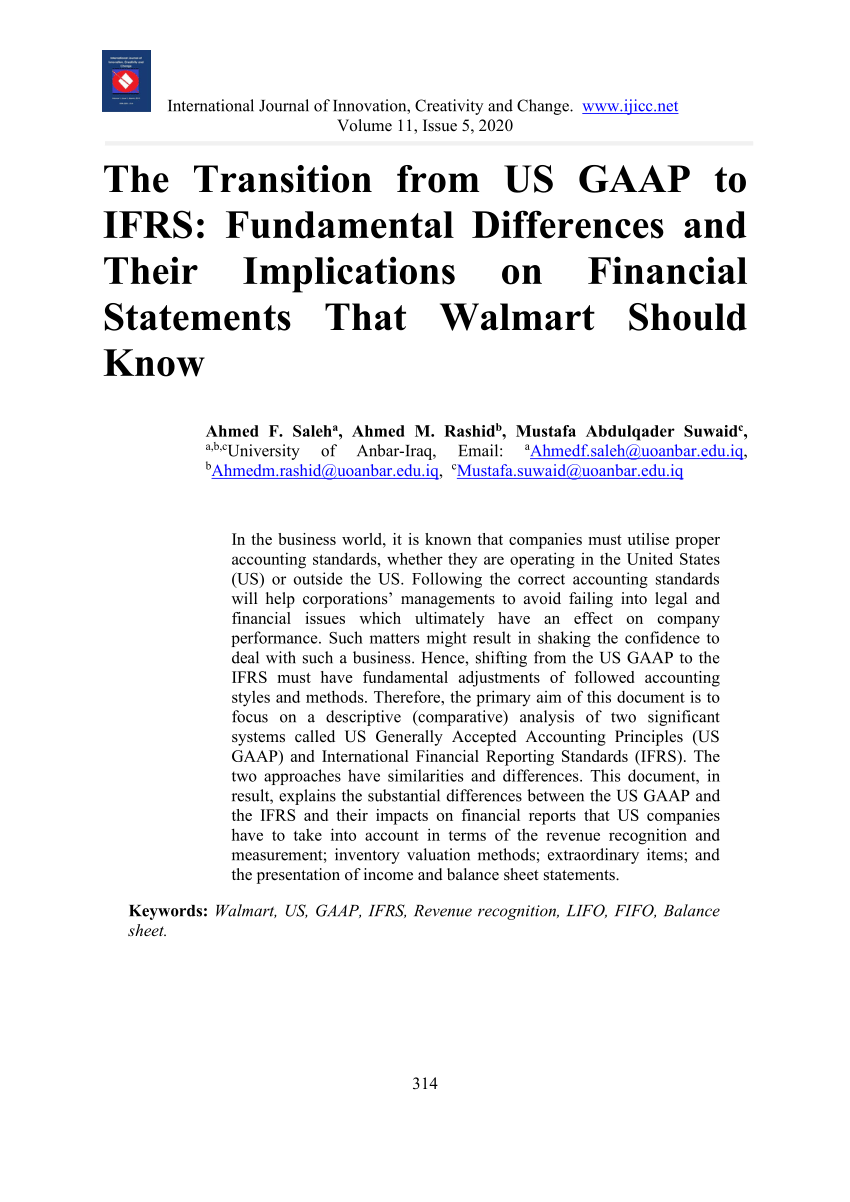

Pdf The Transition From Us Gaap To Ifrs Fundamental Differences And Their Implications On Financial Statements That Walmart Should Know

Cobankchsfirstamendmentt Pertaining To Credit Terms Agreement Template 10 Professional Templates Ideas 10 Prof Professional Templates Agreement Templates

Wiley Regulatory Reporting Wiley Gaap 2021 Interpretation And Application Of Generally Accepted Accounting Princ Accounting Principles Accounting Principles

Ifrs 16 Vs Asc 842 The Differences In Lease Accounting

Preference Shares And Its Features Financial Strategies Accounting And Finance Financial Analysis

Examining The Differences Between United States Generally Accepted Accounting Principles U S Gaap And International Accounting Standards Ias Implications For The Harmonization Of Accounting Standards Sciencedirect

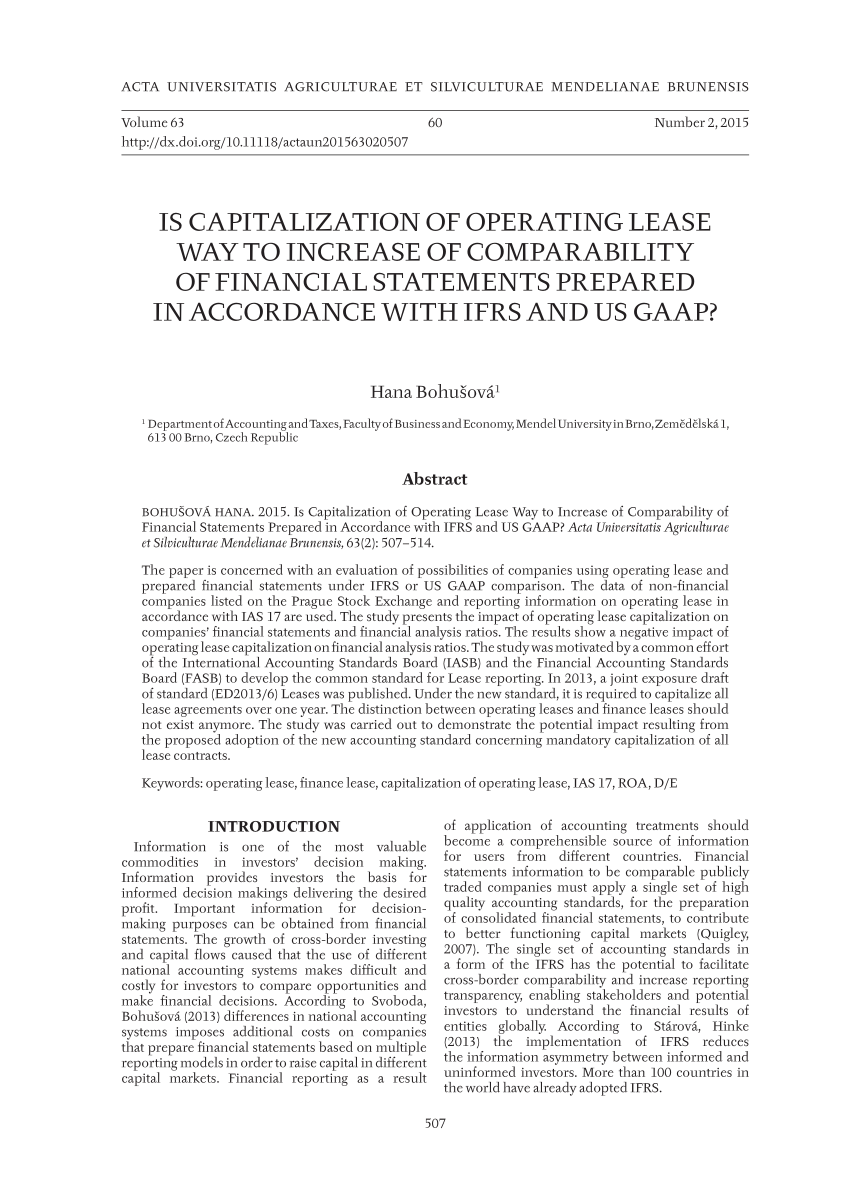

Pdf Is Capitalization Of Operating Lease Way To Increase Of Comparability Of Financial Statements Prepared In Accordance With Ifrs And Us Gaap

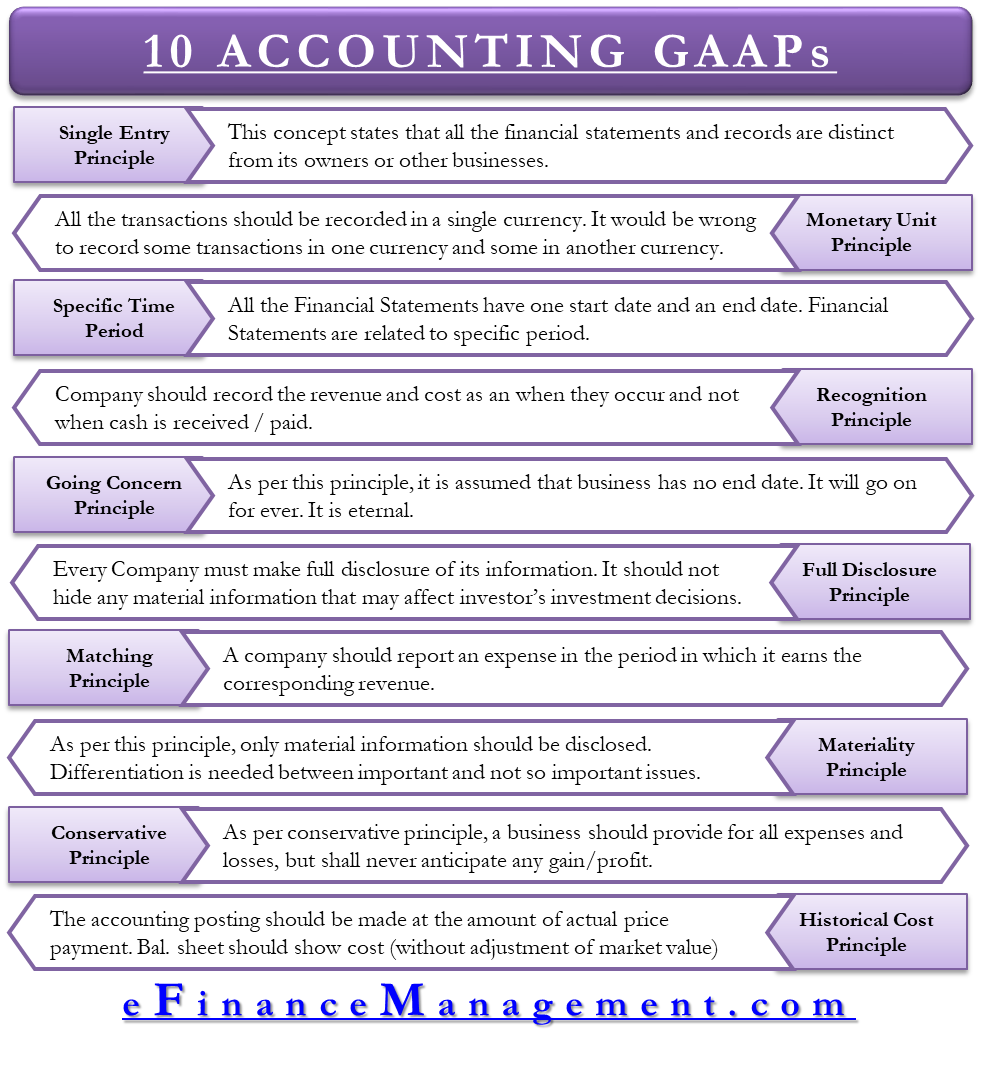

What Are All 10 Gaap Principles Origin Brief Description Of Each Efm

Comments

Post a Comment